Building our Community by Connecting Donors Who Care with Causes that Matter

The Hillsboro Community Foundation serves to promote and facilitate charitable giving in support of projects and programs that enhance the quality of life in Hillsboro and surrounding areas.

2026 Competitive Grant Cycle

The Hillsboro Community Foundation is excited to announce its 2026 Competitive Grant Cycle, running from January 5 through February 4. Local community organizations are invited to apply for funding to support projects that strengthen and enrich local life. Applications will be accepted online during the cycle, and all submissions must be completed by February 4. This is a great opportunity to bring meaningful projects to life in our community.

The Power of an Endowment

An endowment is a gift that keeps on giving. It’s like planting a seed that grows into a mighty tree, providing for generations to come. The principal is invested, and the earnings are used to support a designated cause, ensuring a perpetual source of funding. This enduring power allows endowments to fuel innovation, advance knowledge, and uplift Hillsboro far beyond the initial investment.

Transfer of Wealth in Marion County

Marion County anticipates a major generational wealth transfer, mirroring a statewide trend involving hundreds of billions over the coming decades. Retaining even a small fraction of this wealth through a local community foundation offers a powerful opportunity to benefit the community for generations.

Community Impact

-

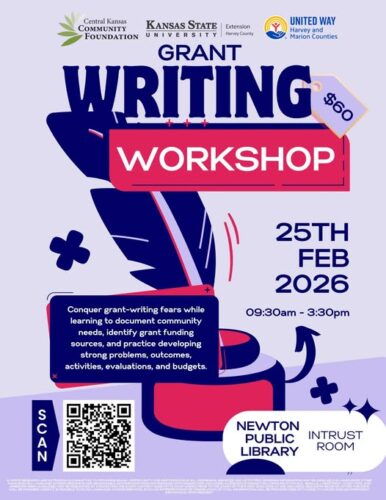

Grant Writing Workshop – Feb. 25,2026

Conquer grant-writing fears while learning to document community needs, identify grant funding sources, and practice developing strong problems, outcomes, activities, evaluations, and budgets. Co-hosted by: Central Kansas Community Foundation, K-State Extension Harvey County, and the United Way of Harvey and Marion Counties. Date: February 25, 2026; 9:30 AM – 3:30 PMLocation: Newton Public Library (Intrust […]

Read More

-

Philanthropy is for everyone: Three tips for young adults

“Philanthropy” may sound like something reserved for wealthy, “mature” adults, but that’s not at all the case. At the community foundation, we work with individuals of every generation, from young adults to retirees and everyone in between. Young adults in particular are getting involved in the community in ways that look a little different from […]

Read More

Giving by the Numbers

-

$1,958,000

Community Impact

-

$158,600

Scholarship Awards

-

$3,450,000

Endowment Assets

-

Volunteer Today

Sign Up

-

Affiliate Benefits of CKCF

Learn More

-

Community Disaster Relief

Contribute